Pay Stub Generators: Features, Pricing, and How They Stack Up Against Each Other

In today’s busy world, employers and employees want things to be easy and quick when dealing with their finances. One area that has improved a lot with technology is payroll management. Pay stub generators are helpful tools that automatically create pay stubs for employees. This makes the payroll process smoother and reduces mistakes made by humans.

In this article, we’ll look at the main features of pay stub generators and compare their prices. We’ll also check out W2 creator and see how it stacks up against pay stub generators.

Features of Pay Stub Generators

- Template Customization: A crucial aspect of any pay stub generator is its ability to offer customizable templates. Employers should be able to personalize pay stubs with their company logo, address, and other pertinent details to maintain a professional and consistent appearance.

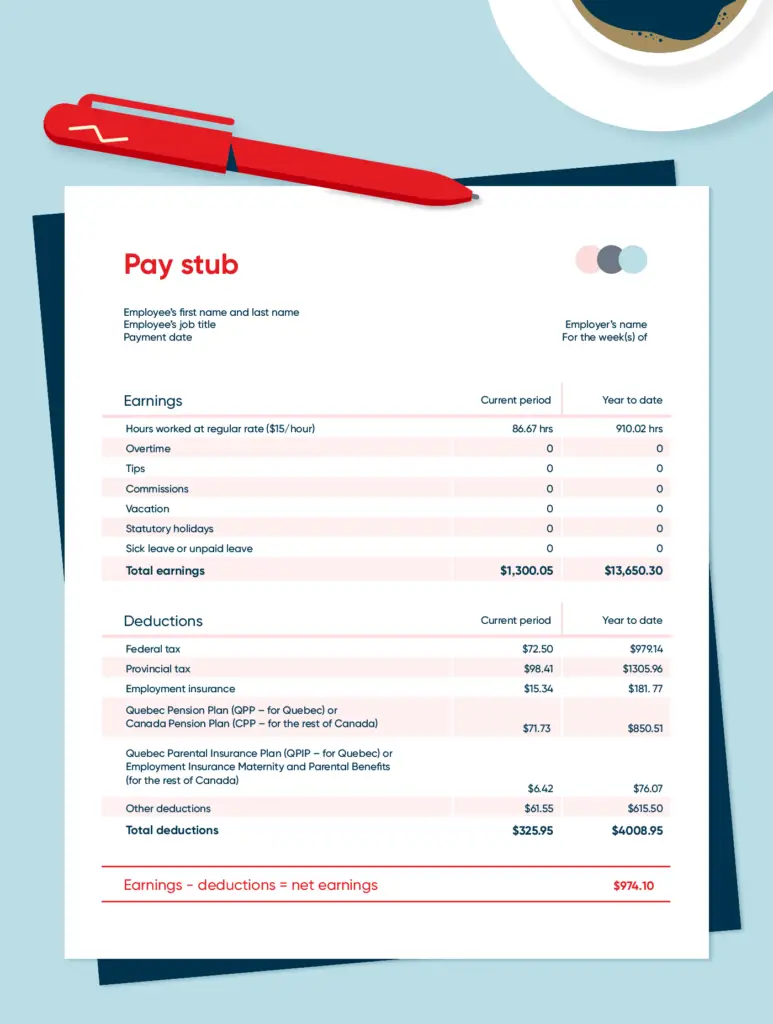

- Accurate Calculation: Pay stub generators must accurately calculate an employee’s gross earnings, deductions, taxes, and net pay based on the entered hours or salaries. Precision in these calculations is vital to ensure employees receive the correct compensation.

- Tax Compliance: Adhering to tax regulations is a priority for any business. Pay stub generators should accommodate federal, state, and local tax laws, ensuring that tax deductions are accurately reflected on each employee’s pay stub.

- Direct Deposit Integration: The integration of direct deposit functionality enables employees to receive their pay electronically, enhancing convenience and reducing the need for paper checks.

- Accessibility and Security: The pay stub generator should provide a secure platform for accessing and storing sensitive financial information. Implementing encryption and other security measures ensures that data remains confidential and protected from potential cyber threats.

- Record-Keeping and Reports: An efficient pay stub generator should maintain a comprehensive record of past pay stubs, enabling easy retrieval and access for employers and employees. The ability to generate reports can also aid in payroll analysis and budgeting.

Pricing Models of Pay Stub Generators

The pricing structures of pay stub generators can vary significantly depending on the features offered and the provider. Standard pricing models include:

- Free Versions: Some pay stub generators offer basic features for free, making them ideal for small businesses with minimal payroll needs. However, these free versions may come with limitations regarding template customization and data storage.

- Subscription-Based Plans: Most pay stub generator services offer tiered subscription plans based on the number of employees or the frequency of pay stub generation. These plans typically offer more features and customization options at higher prices.

- One-Time Purchase: Certain pay stub generators may offer a one-time purchase option, granting unlimited access to all features without the recurring costs associated with subscription plans. This can be a cost-effective solution for long-term use.

Comparison of Leading Pay Stub Generators

- PayStubCreator.net: This pay stub generator offers a user-friendly interface with many customizable templates. It provides accurate tax calculations, direct deposit integration, and secure data storage. It operates on a subscription-based model, making it suitable for businesses of all sizes.

- PaycheckStubOnline.com: PaycheckStubOnline.com offers a free version with limited features and premium subscription plans. While it includes essential customization options, its tax compliance may be restricted to certain regions.

- StubCreator.com: With a one-time purchase option, StubCreator.com offers unlimited pay stub generation, customizable templates, and tax compliance for various regions. This can be an excellent choice for small to medium-sized businesses looking for a cost-effective solution.

What Is W2 Creator And What Are Its Features?

The W2 Creator is a tool designed to help businesses generate W-2 forms for their employees. These forms are essential for reporting employees’ annual wages and the taxes withheld from their paychecks to the Internal Revenue Service (IRS). The W2 Creator simplifies creating these important documents, saving time and reducing the chances of errors.

Some key features of the W2 Creator include a user-friendly interface, the ability to import employee data, automatic tax calculations, and options for printing or electronically distributing the W-2 forms to employees. With its convenient features, the W2 Creator is an invaluable resource for businesses during tax season.

Conclusion

Pay stub generators have revolutionized payroll management, providing businesses with a streamlined, efficient, and accurate solution for generating pay stubs. The choice of pay stub generator will largely depend on a company’s specific needs, such as the number of employees, budget constraints, and desired features.

When comparing pay stub generators, it is essential to consider their template customization options, accuracy in tax calculations, direct deposit integration, security measures, and pricing structures. Businesses should evaluate their requirements carefully to make an informed decision and choose the pay stub generator that best aligns with their unique needs and goals.

Remember, the efficiency and accuracy of your payroll system can significantly impact employee satisfaction and overall business performance, so investing in a reliable pay stub generator is a step towards optimizing your financial processes.