Klarna Competitors and Similar Companies

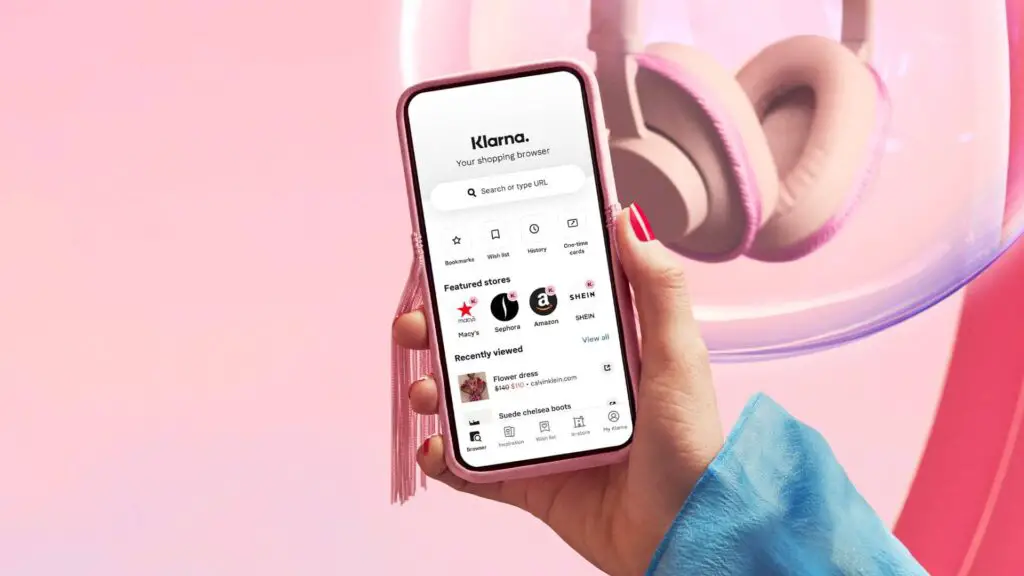

Klarna is a fintech financial company (formally named Klarna Bank AB) that allows consumers to shop with a temporary Visa card. The Swedish company provides online payment processing services for the e-commerce industry, online storefronts, direct transfers, and post-purchase payments.

The company became Sweden’s most utilized payment platform for e-commerce sales in 2021; Klarna claimed 40% of all sales to bag a $45.6 billion valuation that same year.

The company has become a BPNL (Buy now, pay later) service provider as it offers customers credit on purchases as a function of the checkout process.

The online payment platform company was founded in 2005 by Sebastian Siemiatwoski, Niklas Adalberth, and Victor Jacobsonio who participated in the Stockholm School of Economics annual entrepreneurship award in 2005 with their idea.

The company covers 16 locations, serving; the United States, Australia, Austria, Norway, Poland, Canada, Netherlands, Spain, Sweden, Switzerland, Germany, United Kingdom, Italy, France, Finland, Belgium, and Denmark.

| NAME | Klarna Bank AB |

| FOUNDED | 2005 |

| HEADQUARTERS | Stockholm, Sweden |

| SIC CODE | 61,73 |

| STATUS | Private Company |

| INDUSTRY SECTOR | Financial Company (Fintech) |

| EMPLOYEES | 4789 |

| TRADING SYMBOL | N/A |

How Klarna Makes Money

Merchant Charges

Klarna charges merchants a $0.30 fixed fee and a variable fee of as much as up to 6%. The Financing feature on Klarna allows customers to spread the cost by paying monthly. The sellers/merchants have 30 days to pay, where customers pay no interest if the merchant pays full within 30 days.

Commissions on Interchange Fees

Klarna earns a percentage of interchange fees on merchant platforms as a commission and interests earned off consumers’ accounts. Klarna provides a temporary Visa card to consumers for purchase. When a consumer makes a successful purchase, an interchange fee (around 1%) is paid by the merchant to the card issuer.

Klarna Similar Companies

The 12 biggest rivals to Klarna are;

- Affirm

- Skrill

- PayPal Credit

- Sezzle

- GoCardless

- Afterpay

- Zip

- Stripe

- Splitit

- QuadPay

- ViaBill

- Laybuy

Klarna was able to build the platform when Jane Walerud (an investor) put the company in contact with a programmer who helped to invent the platform. By the end of the year 2007, Venture Capital firm Investment AB Ӧresund invested in the company. The company started selling in 3 locations to grow and add 2 more in 2010. Klarna increased its revenues to USD 54 million in 2010 after Sequoia Capital in San Francisco invested in the company.

Buy Now Pay Later Market Size, Share, Trends, Report 2022-2030 – precedenceresearch

Now, let’s discuss the top 12 Klarna competitors.

Affirm

Affirm is a public fintech company operating as a financial lender of installment loans for customers to use at points of sale for financing purchases. The company was founded in 2012 by Max Levchin, Nathan Gettings, and Co. as an initial portfolio of setup studio HVF. Levchin, who was a co-founder of PayPal, became the CEO then.

The company operates by doling out consumer and installment loan product offers. This product offer was launched in 2017 before its partnership with Walmart. Affirm was made available to in-store customers and those on Walmart’s website.

Affirm became listed on NASDAQ as an AFRM trading stock symbol. The company raised ~1.2 billion in its Initial Public Offering (IPO).

Similarities between Affirm and Klarna

- Affirm and Klarna offer buy-now-pay-later financing for purchases when on participating retailing platforms.

- Both have apps available on Apple iOS and Android operating systems.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $965 million | $1.5 billion | San Francisco, California, US | 2,071 |

Skrill

Skrill is a financial private company that offers a digital wallet provider platform offered in 40 different legal tender currencies. Money can be transferred, saved, and uploaded to customers’ Skrill accounts using various payment methods – by card, bank transfer, and other payment options.

The company is parented by the Paysafe Group. Skrill has been licensed to operate in Europe and globally as Operated by the Paysafe Payment Solutions Limited. Skrill was priced and acquired at €855 million. The company is incorporated in Ireland and regulated by the Central Bank of Ireland.

Skrill products include its Payment gateway, Digital Wallet, Prepaid card, and PSP. Skrill is currently used worldwide.

Similarities between Skrill and Klarna

- Both are SaaS products with offers to help hold money in an online account for later use (purchase, transfer, etc. Although Klarna is mainly for purchase).

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $110 million | — | London, United Kingdom | >2000 |

PayPal Credit

PayPal Credit is a subsidiary of the public fintech payment company, Paypal. The platform (formerly known as Bill Me Later – BML) serves as a payment conversion and merchant payout company.

The PayPal-owned online merchant proprietary payment method is used by merchant platforms including; Walmart, Home Depot, eBay, Best Buy, and others. The company was founded in 2000.

PayPal Credit operates on a Series D funding type.

The payment website keeps customers’ accounts funded through Synchrony Bank.

Customers open their accounts with PayPal and PayPal Credit asks them to log in at the point of every purchase and complete their transactions initiated on other merchant platforms with the PayPal Credit payment option. The approved customer can pay their bill by mail check, phone, or via bank account.

Not many online retailers accept PayPal Credit as their payment method option. It is not usually available on all websites where PayPal is approved.

Similarities between PayPal Credit and Klarna

- Money Transfer – You can transfer money (send or receive) from any other account, on both platforms.

- Both are popular e-Wallets.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| ~ $22 billion | $216 million | Timonium, Maryland, US | 10,900+ |

Sezzle

In 2016, Sezzle was founded as a public fintech company to provide an interest-free payment platform in the United States and Canada. The e-payment platform launched in 2017. The platform enables participating online stores to split payments into four installments. The first payment is due at purchase and the other three are within a regular interval over six weeks.

Sezzle became an official alternative payment platform, offering installment plans on some selected online stores with no interest attached. As of 2021, the Sezzle platform had over 40,000 registered merchants, with an accompanying figure of over 7.8 million sign-ups.

Similarities between Sezzle and Klarna

- Both software payment platforms perform a soft credit check.

- Both offer BNPL credit payment in a four-installments payment plan.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $86.3 million | $301.6 million | Minneapolis, US | 523 |

GoCardless

GoCardless (founded in 2011) is a new payment platform for small businesses and enterprises with invoice and subscription payment plans. The choices of payment options are made available to suit flexible recurring payments for businesses. The company sought to provide solutions to target companies that needed to offer recurring bank-to-bank transfers for payments (referred to as Direct Debit in the UK).

Payment collection service is made available around the world, including; the UK, Europe, the USA, Canada, and Australia.

GoCardless offers API and off-the-shelf integrations that help them in partnership with more than 100 partners which include; Sage and Zuora, and Xero. Companies that use GoCardless API include; Thomas Cook & Box and The Guardian.

Similarities between GoCardless and Klarna

- Both are very popular payment providers.

- Pricing features are not too different for both providers.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $295.2 million | $529.3 million | London, UK | 1476 |

Afterpay

Afterpay Limited is a financial technology company that offers a buy-now-pay-later (BPNL) purchase payment option. The brand is an Australian company founded in 2014 by Nick Molnar to serve and operate actively in Australia, New Zealand, Canada, the United States, and the UK. The parent company is Block, Inc. The payment platform has gained over 16.2 million subscribers, amassing a revenue of $519 million and more in the year 2020.

After has recently been acquired by Square, as Square has bid to pay $39 billion in stock for the acquisition.

The Afterpay online platform for point-of-sale financing allows users/consumers to make installment payments (without necessary upfront payment) for purchased products at partnered stores.

Similarities between Afterpay and Klarna

- Both fintech companies offer buy-now-pay-later installment payments.

- Consumers can purchase items without paying upfront on both platforms.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $320.3 million | $448.7 million | Melbourne, Australia | 1760 |

Zip

Zip Pay is a subsidiary of Zip Co. The SaaS company offers a digital wallet that provides an interest-free BNPL purchase payment platform. The fintech company was founded by Larry Diamond and Peter Gray in 2013.

Zip offers customers credit options for online shopping with fair and transparent payment models, bank transfers, and virtual cards. The payment platform serves 14 geos around the world including; Australia, New Zealand, the UK, United States.

The BNPL payment plan allows paying in four interest-free intervals over six weeks.

Companies that offer Zip pay include; AliExpress, Airbnb, Advance Auto Parts, Alexander McQueen, Alibaba, etc.

Similarities between Zip Pay and Klarna

- Both are fast BNPL online payment vendors.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $213.7 million | N/A | Sydney, Australia | 1174 |

Stripe

Stripe provides a suite of APIs that powers online payments for e-commerce stores. Web developers can use these APIs to integrate payment processing into their apps and websites. This fintech SaaS company’s platform allows businesses of all sizes to accept payments and scale sales faster.

Stripe Inc., is a private Irish-American company founded in 2009 by Irish entrepreneurs, John and Patrick Collison (who are brothers). The company received an investment of $2 million from PayPal founders, Elon Musk and Peter Thiel.

Stripe is used by big companies like; Spotify, Ford Motors, etc. Stripe entered a 5-year partnership deal with Ford Motors to help process vehicle orders and reservations.

The company released an anti-fraud tool, “Radar”. This tool helps to detect fraudulent transactions and block every connected purchase.

Similarities between Stripe and Klarna

- Klarna is used on some web-app payment platforms with Stripes’ integration.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $1.26 billion | $2.2 billion | San Francisco, California | 6803 |

Splitit

Splitit is a card-based BNPL online payment service that allows customers to split up payments without interest or fear of accruing loans. The company offers its Installments-as-a-Service platform to boost sales for registered merchants (enterprises and SM Businesses).

Similarities between Splitit and Klarna

- BNPL payment options in both platforms may attract late fees if credit/loan is not fulfilled on time.

- Both payment platforms provide cards for payment options.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $13 million | $260.9 billion | New York, US | 540 |

QuadPay

Quadpay (also, Quadpay, a Zip Co.) was founded in 2017 by Adam Ezra and Brad Lindenberg. The online payment fintech is also a buy-now-pay-later (BPNL) consumer finance product owned by Zip Co. The payment platform allows buyers to split purchases into four interest-void payments that spread over six weeks.

QuadPay had 3 major investors, including Rudyard Partners LLC and Rainfall Ventures.

QuadPay is now officially Zip after it was fully acquired by Zip. So, there’s not much information independently regardless of Zip Co. and other fintech payment products such as Zip Pay. QuadPay still drives growth for Zip in the US.

Similarities between QuadPay and Klarna

- Both credit platforms perform a soft credit check on customers’ financial history, which won’t affect credit score.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $6.3 million | $893.6 million | New York, US | 56 |

ViaBill

ViaBill is a payment fintech platform founded in 2010. The service operates majorly in the USA, Spain, Denmark, and other regions of the world.

ViaBill also provides BNPL credit solutions for shoppers on participating merchants’ web stores and apps. This payment plan allows customers to pay for purchases over a six-week time, with interest-free intervals of 4. The CEO (and co-founder) at ViaBill is Jan Lytje-Hansen.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $20 million | $177.3 million | New York, United States | 98 |

Laybuy

Laybuy is a fast-growing BNPL purchase payment provider with leading markets in the UK and New Zealand. The company also has a growing presence in Australia. The fintech payment company was co-founded by Gary Rohloff and his son, Alex, in New Zealand. The private-owned company has over 1200 retail shops and merchants participating in the subscription plan.

| Annual Revenue | Funding | Headquarters | EMPLOYEES |

| $17 million | $130.9 million | Asia-Pacific, Australasia | 117 |

CONCLUSION

Klarna’s biggest competitor is Affirm. Both BNPL payment platforms have a prolific service in international top online merchant companies and partner with external payment platforms for wider coverage.

Future storefronts will give more access for purchase to customers who are willing to use BNPL offers with softer credit checks and more credit points offered to retain their recurring payment transaction with any merchant of choice anywhere in the world.